In late March, as COVID-19’s twin invasion of the world’s population and the global economy worsened, leaders from the G20, an informal group of 19 countries and the European Union, gathered – virtually, of course – to commit to a united front against the novel coronavirus.

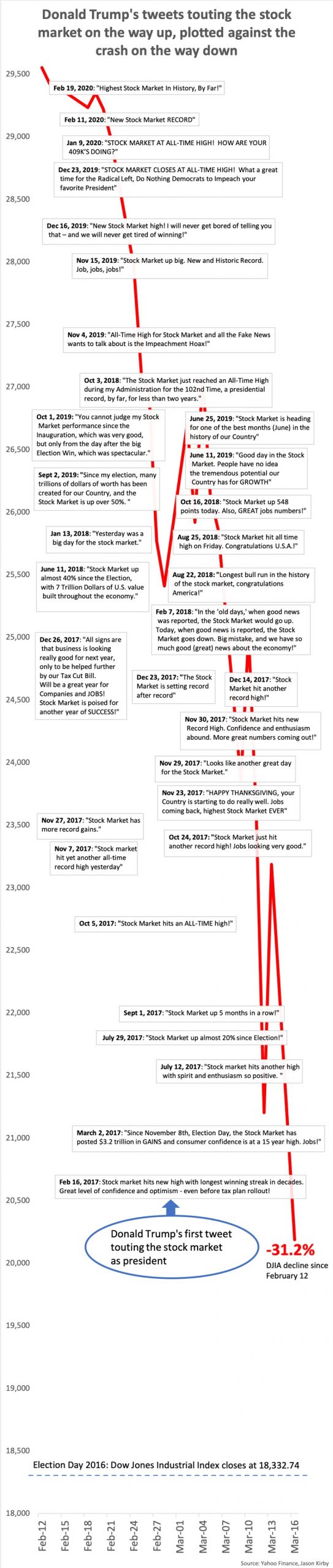

Their pledge to do “whatever it takes” to overcome the crisis became the war cry of public health officials, finance ministers and central bankers. But trillions of dollars in emergency spending later, it’s still not clear that “whatever it takes” will be enough to pull the global economy out of its tailspin.

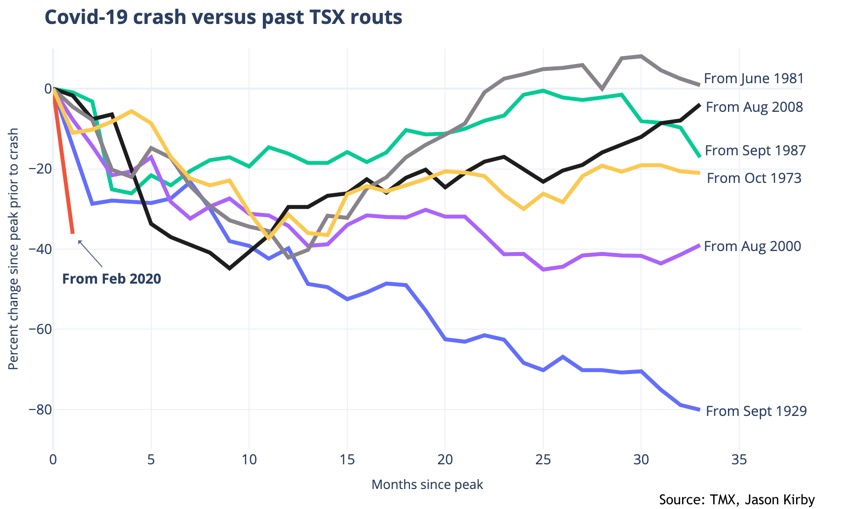

The viral outbreak and what some are calling the Great Lockdown meant to curb its spread have delivered an unprecedented shock to the economy and people’s savings. And it comes at a time when millions of Canadians are in their prime earning years ahead of retirement and many millions more retirees were trying to max out their investments.