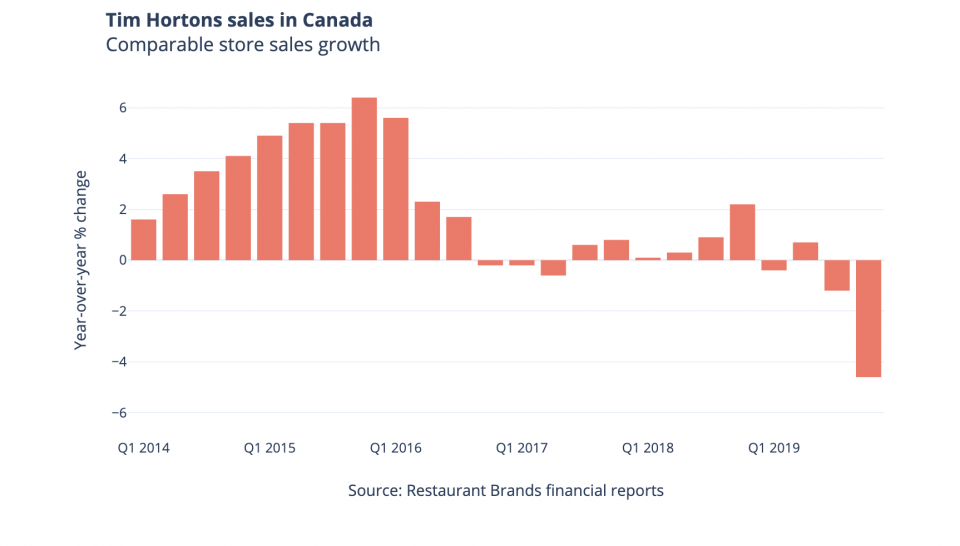

Tim Hortons has a serious Canada problem. Simply put, too many Canadians no longer think of Timmies as the folksy Canadian coffee and donut shop it once was. And they’re abandoning the chain in droves.

The latest financial results of Restaurant Brands International, the quick serve restaurant conglomerate that owns Tim Hortons, tell the bitter tale. In the fourth quarter same-store sales at Tim Hortons in Canada, a measure that tracks the performance of locations that have been open for 13 months or more, fell 4.6 per cent. The awful results in the last quarter were partly due to the large number of coffee giveaways through the Tim Hortons loyalty program, a rewards scheme the company now plans to overhaul, but this is a problem that’s been building over the past four years. Canadians have lost faith in Tim Hortons.